nassau county tax grievance application

The form can be completed by yourself or your representative or attorney. If you mail the form it must be received by the assessor or BAR no later than Grievance Day.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Click this link if you prefer to print out the application in PDF form and fax it to.

. Over 450000 Nassau County homeowners filed a tax grievance over the past two years. When your neighbors apply and get successful reductions some of that cost is passed on to you. This website will show you how to file a property tax grievance for you home for FREE.

New York City residents. The question here is What would you do if you got an inaccurate property assessment. New York City Tax Commission.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions. For a 1 2 or 3 Family House pdf file Instruction for form AR1.

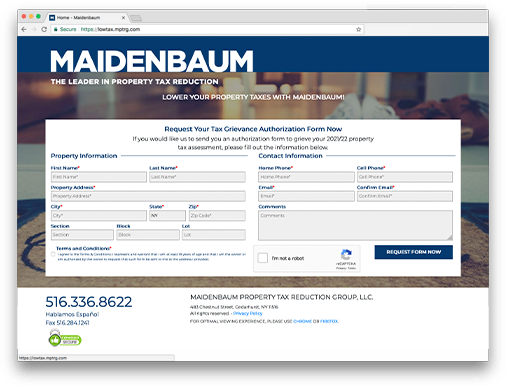

Best Tax Relief Companies of 2022. For Other types Property pdf file Instruction for form AR2. E-sign Nassau County Tax Grievance Application Suffolk County Tax Grievance Application Click on the County Name to Download and Complete the Tax Grievance Application You can print and then fax your application to us at 631-782-3174.

For Tax Class and Exemption Claims pdf file Instruction for form AR3. Click Here to Apply for Nassau Tax Grievance. End Your Tax Nightmare Now.

You May Qualify For An IRS Hardship Program If You Live In New York. Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers. At times the assessments might be inaccurate.

Pay Just 50 of first-year reduction No one will visit your home The Heller Consultants Tax Grievance Group is composed of tax grievance professionals who are dedicated to saving our clients money through the property tax grievance process. Dont get stuck paying more than your fair share while others pay less. These Tax Relief Companies Can Help.

You can follow our step-by-step instruction to file your tax grievance with the Nassau County Department of Assessment to have your property taxes lowered for FREE or have one of our staff file you grievance for you. Completing the grievance form Properties outside New York City and Nassau County. At the Cobra Consulting Group we provide consulting for select services on a concierge basis so you can meet your business requirements efficiently without having to retain multiple service providers.

Nassau County Tax Reduction Application. We offer this site as a free self help. You then have until April 15th to.

Our professionals have extensive experience and knowledge in the field of property tax. NO REDUCTION NO FEE Calculating our fee is easy. Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment.

Nassau County Tax Grievance Application 2016-03-01T154626-0500. File the grievance form with the assessor or the board of assessment review BAR in your city or town. Pay Just 50 of 1st Years Savings Tax Grievance Applications Click on the County Name to Apply Online NOW.

Ad Owe The IRS. You have the legal right to challenge your homes assessment EACH YEAR. Ad Owe Over 10K in Back Taxes.

Submitting an online application is the easiest and fastest way. Please check back in a few days to sign up for next year. Ad Access Tax Forms.

The first step in the process is to file an affidavit with your county assessors office within six months after the assessment date on which the taxes are based or before June 30th if you have not yet received that notice. Nassau County Tax Grievance Form. Well you can make an appeal whereby you fill an application with the Assessment Review Commission.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes. Complete Edit or Print Tax Forms Instantly.

Between January 3 2022 and March 1 2022 you may appeal online. Nassau County Assessment Review Commission. Ways to Apply for Tax Grievance in Nassau County.

Deadline for filing Form RP-524. Ad 4 Simple Steps to Settle Your Debt. ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your.

As of 2 January 2018 The Nassau County Department of Assessment carried out an assessment on each property in the region. Ad Based On Circumstances You May Already Qualify For Tax Relief. In most communities the deadline for submitting Form RP-524 is Grievance Day see below.

The Nassau County Department of Assessment offers a property tax appeal process.

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Wishing You A Season Of Peace And Joy Malverne Rockville Centre Chalkboard Quote Art

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

Sergey Borohov Nassau County Mineola Real Estate News

New To The Market In Rockville Centre Carol Gardens Co Op Rockville Centre House Styles Rockville

Pin On Real Estate News Magazines

Tax Grievance Appeal Nassau County Apply Today

Tax Grievance Appeal Nassau County Apply Today

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Nassau County Property Tax Reduction Tax Grievance Long Island

5 Myths Of The Nassau County Property Tax Grievance Process

1199 E 53rd St 7k Brooklyn Ny 11234 Trulia Trulia Spacious Living Room Brooklyn

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance